Finally, a tax-slashing roadmap for your business…

Business owners, I have three questions for you…

Are you happy with the amount of taxes you have to pay?

Are you confident that you’re taking advantage of every deduction?

When was the last time your accountant or tax professional came to you and said, “I have an idea that will save you some money on your taxes”?

If you answered “no” to either of the first two questions, or “Never” to the final question…. We need to talk!

How much money could a customized business tax plan add to your bottom line?

Studies show that 93% of business owners pay too much in tax. Our survey of over 2,000 business owners identified an average of over $27,000 in annual tax savings. Put your newfound savings back into the business, away for retirement, or whatever suits your needs.

Let the tax-slashing plan do all the work for you.

Any accountant qualified to “do taxes” can prepare your return for you, but smart business owners recognize that they can only achieve their greatest tax savings with a well-crafted, professional tax plan that’s personalized and unique to you and your business. We explore over 1400 potential federal, state, and local deductions to create your tax plan.

After I get my tax plan, can Premier Tax do the taxes for me?

Yes, of course. Not only do we create a customized tax-reduction plan for your business, but our experts know how to execute the plan.

Unfortunately, not all accountants are created equal. You need a plan, but you also need experts that can execute it with you. It’s more than just checking the right boxes on a form. We’ll help you make adjustments to your business so you can take full advantage of your plan. Have a CPA or tax prep firm you already like? That’s no problem, simply take your plan to them to implement on your behalf.

How much will it cost me if I don’t plan?

The old adage is true: “if you fail to plan, you plan to fail.” Just imagine multiplying the average annual savings of $27,000 per year over 5 years ($135,000) or even 10 years ($270,000) Can you afford to continue to miss out on substantial tax savings?

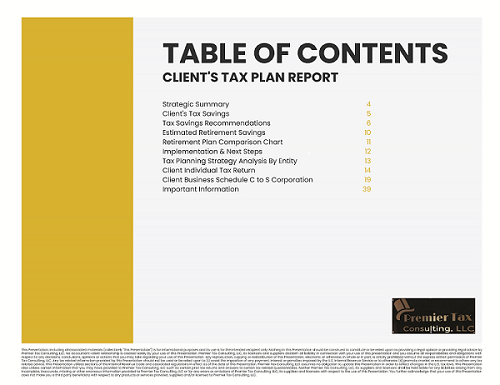

Here’s a sample snapshot of a tax reduction plan

Your tax plan will be 20-50+ pages (with all of the actionable details) so what follows are just a few highlights

Sample plan. Individual results vary.

Thousands of Tax Planning Strategy Combinations

Our team of tax strategists considers over 1,400 federal, state and local deductions as we review your unique situation. We find the most effective tax strategies for maximizing deductions, legal entity structure, retirement planning, insurance and asset protection, economic relief programs like the CARES Act, exit and capital gains, and other advanced strategies.

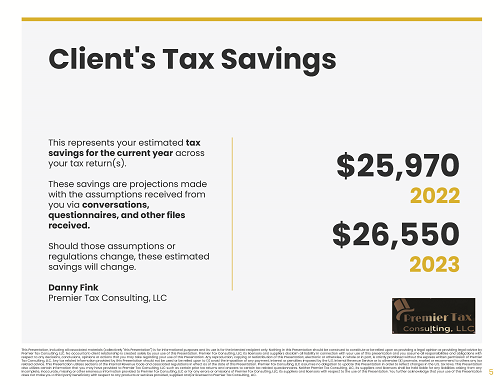

Overall tax savings

Our strategic roadmap to slash your tax expense starts with the end in mind. At the top of the 20-50+ page tax reduction report you’ll find your estimated tax savings for the current year as well as the projected savings for the next year, all based on the assumptions you’ve given us.

Sample plan. Individual results vary.

.

Sample plan. Individual results vary.

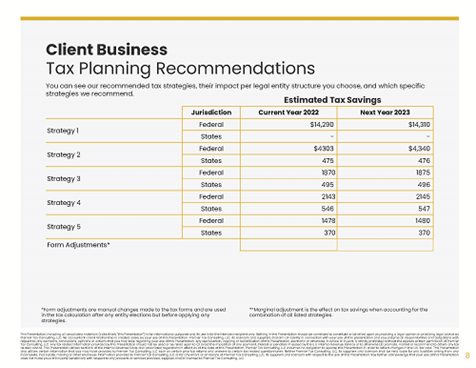

Tax Planning Recommendations

Tax laws are always changing, so that’s why our team is constantly keeping up with the latest opportunities to reduce business tax.

We’ll identify the strategies you’re missing, including the nuances for different entity structures, and what we recommend you do to put more money back into your business.

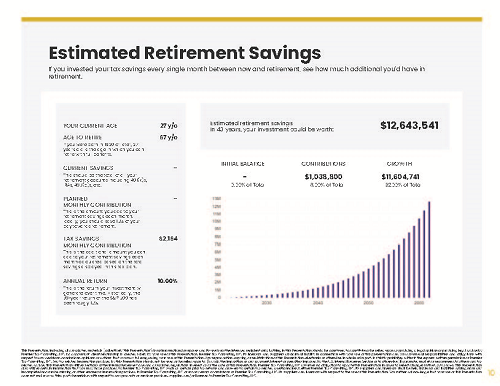

Estimated Retirement Savings

You’re probably not thinking about retirement yet, but it’s on the horizon somewhere, right? So that’s why we highlight what it would look like if you took your new tax savings and invested it every month toward retirement.

Sample plan. Individual results vary.

Sample plan. Individual results vary.

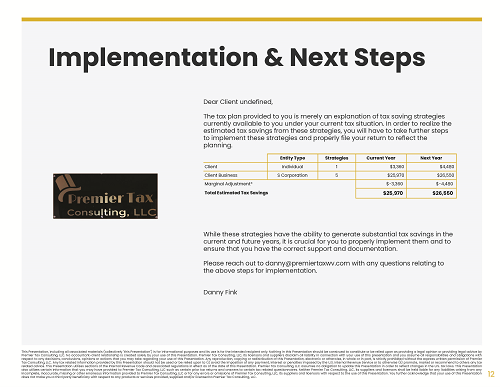

Next Steps – Take Action

A plan is only as good as its implementation. We provide the details you need in your 20-50+ page report for a willing and competent tax expert to make your new tax savings a reality.

However, please note: many accountants are either not willing or not proficient enough to put this comprehensive plan into action. At Premier Tax Consulting, we can make your plan a reality.

Frequently asked questions

Why hasn’t my current accountant created a business tax savings plan for me?

We can’t speak for your accountant, but we find that many accountants are not qualified to create a comprehensive plan. They lack the time or staff to accomplish all that is necessary to take full advantage of a comprehensive tax plan or they are simply unaware they are not optimizing their clients’ businesses for tax savings.

How much can I expect to save in taxes when I get a plan?

Because everyone’s situation is unique, we can‘t promise you specific savings until reviewing your situation. However, our internal survey of over 2,000 business owners identified an average of over $27,000 in missing or potential tax savings.

Can I get a plan to see if my accountant is doing everything right?

Of course, we encourage it. Some of our clients simply want a “second opinion” to confirm their accountant, friend, or family member isn’t missing anything.

What if I have questions about getting a tax-slashing plan?

We have dedicated professionals ready to help answer your questions. Call or email us and we’ll be happy to answer your questions. info@premiertaxwv.com or 304-241-5125

OUR TAX SERVICES

SERVICES FOR SMALL BUSINESSES

Recent Posts

Can You Really Deduct 100% of the Airfare with Only One Business Day on A Seven Day Trip to Paris?

When you travel to a business location where you spend the night, you are in travel status. But will the tax rules make this a business or personal night? The rules also affect your costs during the day. When you have an overnight business travel day, you generally...

Use a Single-Member LLC as a Tax-Smart Real Estate Ownership Vehicle

You’ll find much beauty and little beast in using a single-member LLC for your real estate ownership. Should you use a single-member LLC as a real estate ownership vehicle? That might be a very good idea. Under the so-called check-the-box regulations put out years ago...

Vacation Home Rental – What’s Best for You: Schedule C or E?

Do you have a beach or mountain home that you rent out? If the average period of rental is less than 30 days, you likely have a choice—either claim the income and expenses on Schedule C, or claim the income and expenses on Schedule E. When Is Schedule C a Good Choice?...

Converting Your Home to a Rental

The simple maneuver of converting your personal residence to a rental property brings with it many tax rules, mostly good when you know how they work. The first question that arises when you convert a personal residence into a rental is how to determine the property’s...

Unlock Tax Deductions with a Rental Property Home Office

With the start of a new tax year, you’re probably looking for new tax savings opportunities. As you probably know, establishing a home office for your Schedule C or corporate business creates valuable tax deductions. But it’s not available only for your...

Get Paid: Hire Your Child

You can pay your child to work in your business and get paid for paying your child. The basic mechanics of this are (a) you deduct the wages and (b) your child pays zero or very little in income taxes. The three points below elaborate on this: The child (a single...

Get Ready to Say Goodbye to 100 Percent Bonus Depreciation

All good things must come to an end. On December 31, 2022, one of the best tax deductions ever for businesses will end: 100 percent bonus depreciation. Since late 2017, businesses have used bonus depreciation to deduct 100 percent of the cost of most types of property...

2022 Last-Minute Year-End Tax Strategies for Marriage, Kids, and Family

Are you thinking of getting married or divorced? If yes, consider December 31, 2022, in your tax planning. Here’s another planning question: Do you give money to family or friends (other than your children, who are subject to the kiddie tax)? If so, you need to...

How Cost Segregation Can Turn Your Rental into a Cash Cow

Cost segregation breaks your real property into its components, some of which you can depreciate much faster than the typical 27.5 years for a residential rental or 39 years for nonresidential real estate. When you buy real property, you typically break it into two...

Combine Your Home Sale With a 1031 Exchange

You don’t often get the opportunity to even consider making a tax-saving double play. But your personal residence combined with a desire for a rental property can provide just such an opportunity. This tax-saving strategy is to combine the tax advantage of the...

If you need some help with your taxes, if you owe a large amount and don't understand why and/or need a way to bring it down, or if you are in need of payroll services; Premier Tax Consulting needs to be your first and only call!

Blake StewartPremier Tax Consulting did a wonderful job helping me sort through the often confusing world of taxes. Danny Fink is extremely knowledgeable, responsive, highly-qualified and very ethical.

Julie Mills